Research

-

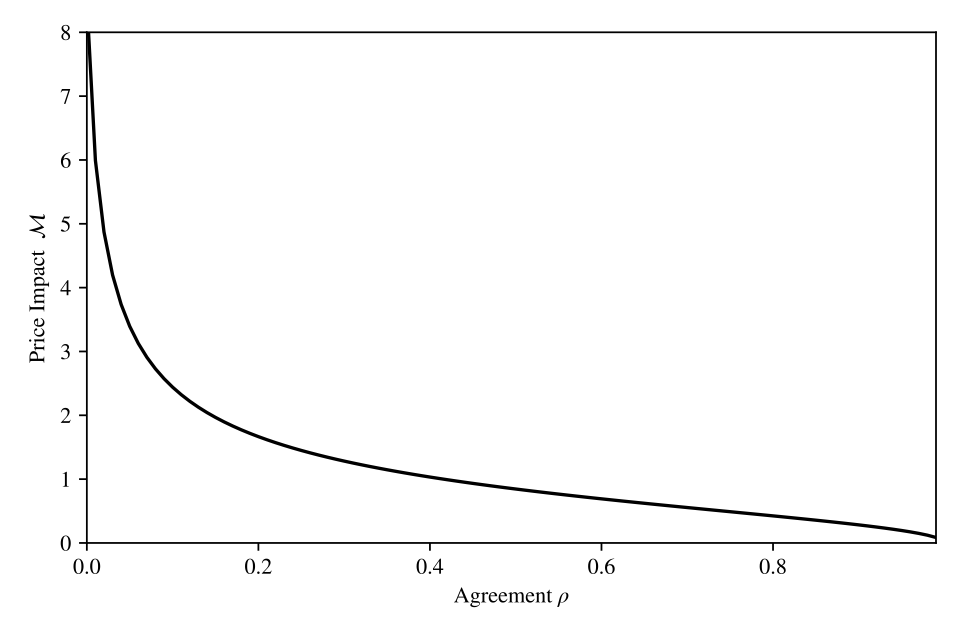

A Bound on Price Impact and Disagreement2025Presentations: Demand in Asset Markets Workshop, Harvard Business School, the University of Hong Kong (HKU), and the Hong Kong University of Science and Technology (HKUST), the 11th BI-SHOF Conference on Asset Pricing and Financial Econometrics, Yale Junior Finance Conference, Olin Business School, Minnesota Junior Finance Conference, Kellogg School of Management, and Federal Reserve Bank of St. Louis

A Bound on Price Impact and Disagreement2025Presentations: Demand in Asset Markets Workshop, Harvard Business School, the University of Hong Kong (HKU), and the Hong Kong University of Science and Technology (HKUST), the 11th BI-SHOF Conference on Asset Pricing and Financial Econometrics, Yale Junior Finance Conference, Olin Business School, Minnesota Junior Finance Conference, Kellogg School of Management, and Federal Reserve Bank of St. Louis -

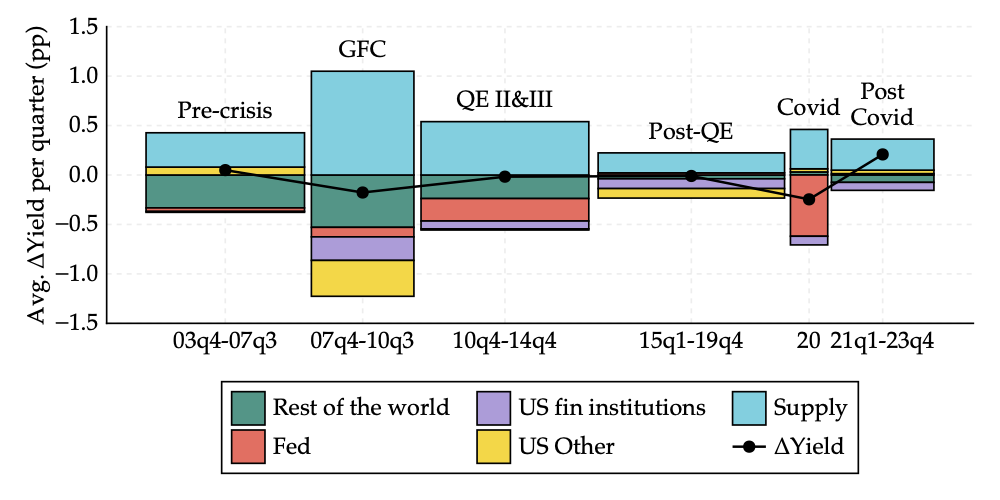

Anatomy of the Treasury Market: Who Moves Yields?2024Awards: Arthur Warga Award for Best Paper in Fixed Income, SFS Cavalcade Asia-Pacific 2025Presentations: HKUST, Bank of Canada, Brown University, HBS Junior Finance Conference (2025), UCLA Conference on Financial Markets (2025), University of Zurich, The Chicago Booth Treasury Markets Conference (2025), Second UIC Finance Conference, the 2025 OFR Rising Scholar Conference, 2025 Sovereign Bond Markets International Conference, NBER SI Asset Pricing (2025), EFA 2025, University of Virginia, Fixed Income and Financial Institutions 2025

Anatomy of the Treasury Market: Who Moves Yields?2024Awards: Arthur Warga Award for Best Paper in Fixed Income, SFS Cavalcade Asia-Pacific 2025Presentations: HKUST, Bank of Canada, Brown University, HBS Junior Finance Conference (2025), UCLA Conference on Financial Markets (2025), University of Zurich, The Chicago Booth Treasury Markets Conference (2025), Second UIC Finance Conference, the 2025 OFR Rising Scholar Conference, 2025 Sovereign Bond Markets International Conference, NBER SI Asset Pricing (2025), EFA 2025, University of Virginia, Fixed Income and Financial Institutions 2025 -

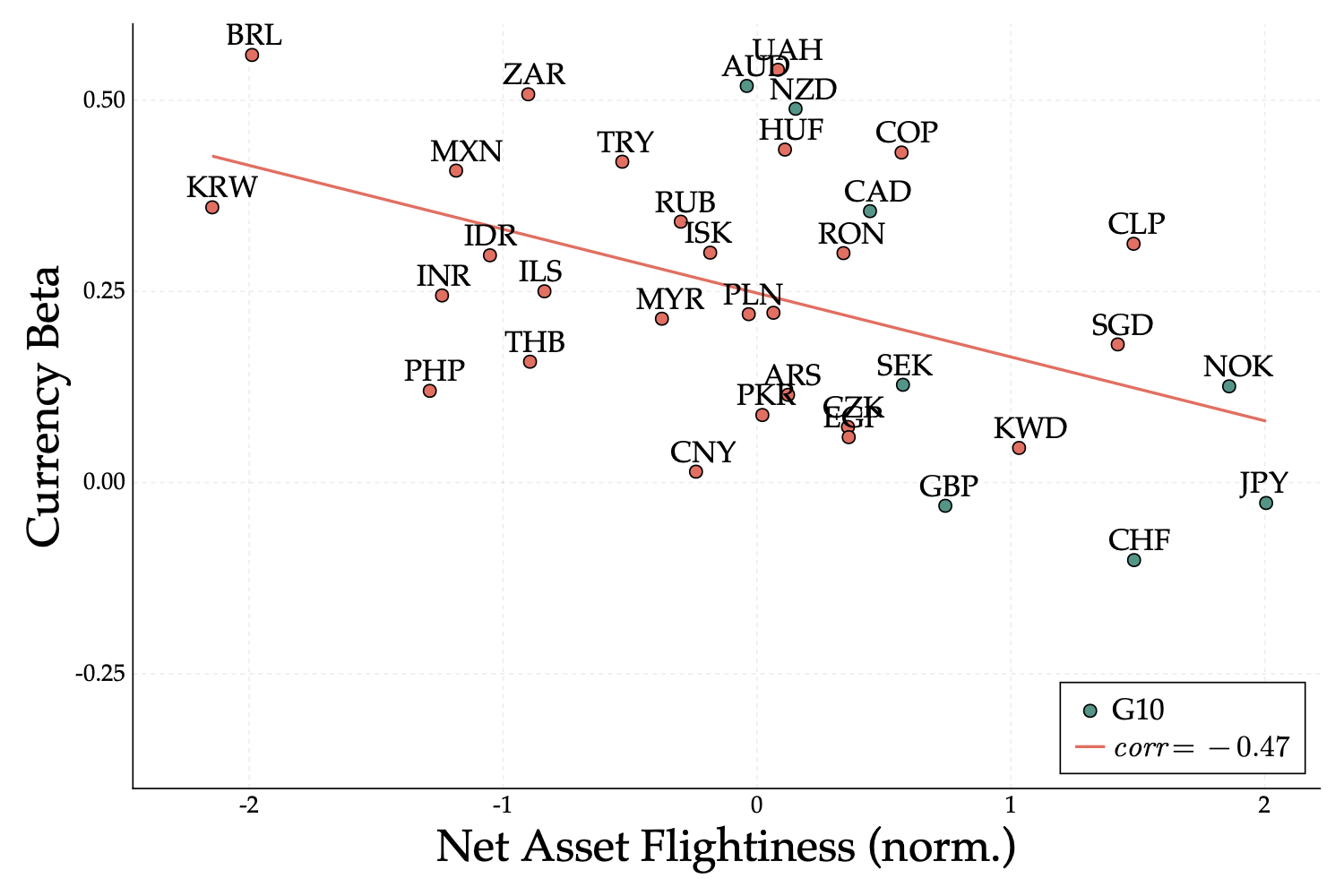

Capital Flows and the Making of Risky Currenciesrevise & resubmit at the Review of Financial Studies2024Awards: BlackRock's Applied Research Award Finalist (2023), Best PhD Student Paper Award at Young Scholars Finance Consortium (2024)Presentations: Colorado Finance Summit Job Market Session 2023, Yiran Fan Memorial Conference 2023, 18th Economics Graduate Students' Conference, 2024 Young Scholars Finance Consortium, 2024 BFI International Macro-Finance Conference

Capital Flows and the Making of Risky Currenciesrevise & resubmit at the Review of Financial Studies2024Awards: BlackRock's Applied Research Award Finalist (2023), Best PhD Student Paper Award at Young Scholars Finance Consortium (2024)Presentations: Colorado Finance Summit Job Market Session 2023, Yiran Fan Memorial Conference 2023, 18th Economics Graduate Students' Conference, 2024 Young Scholars Finance Consortium, 2024 BFI International Macro-Finance Conference -

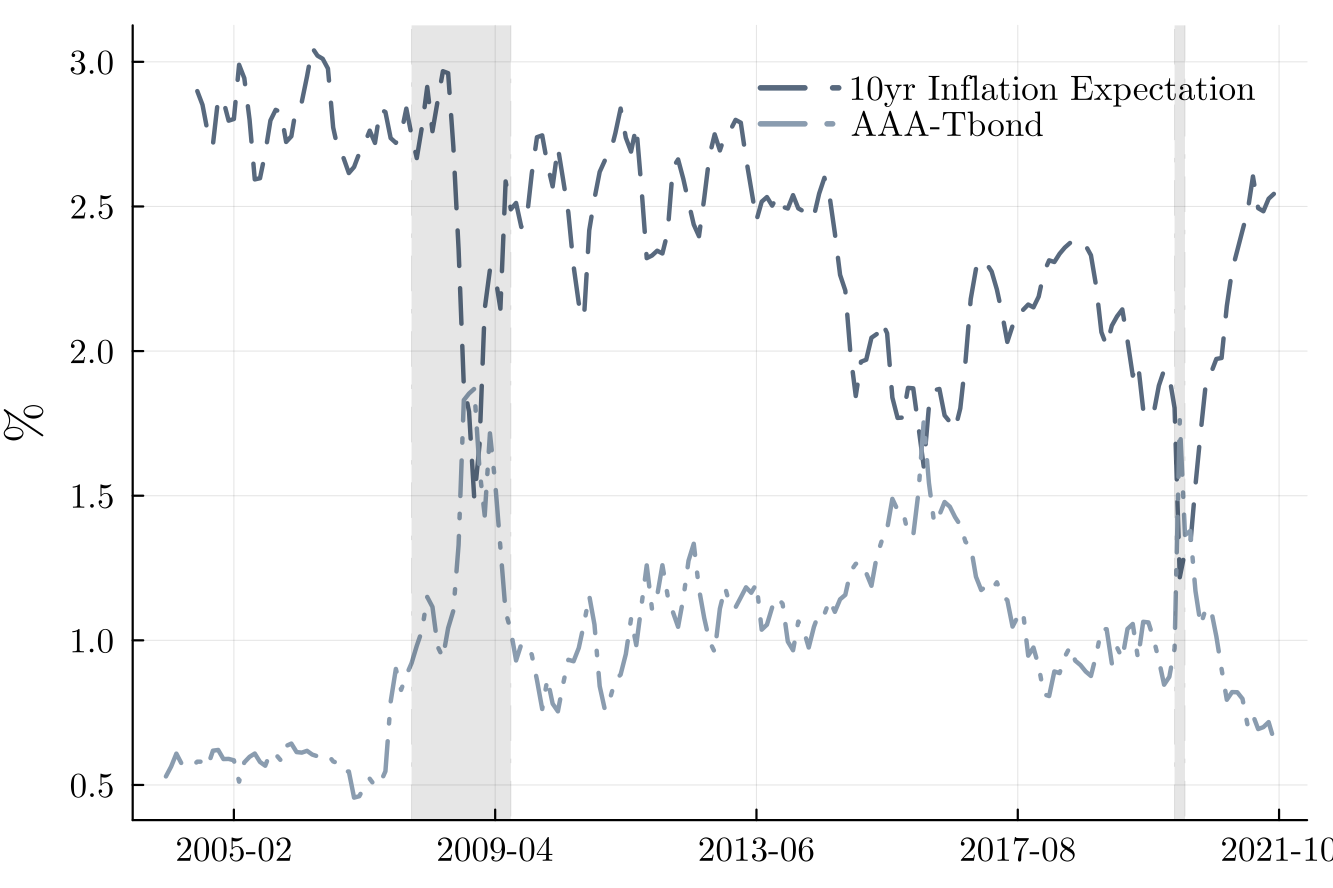

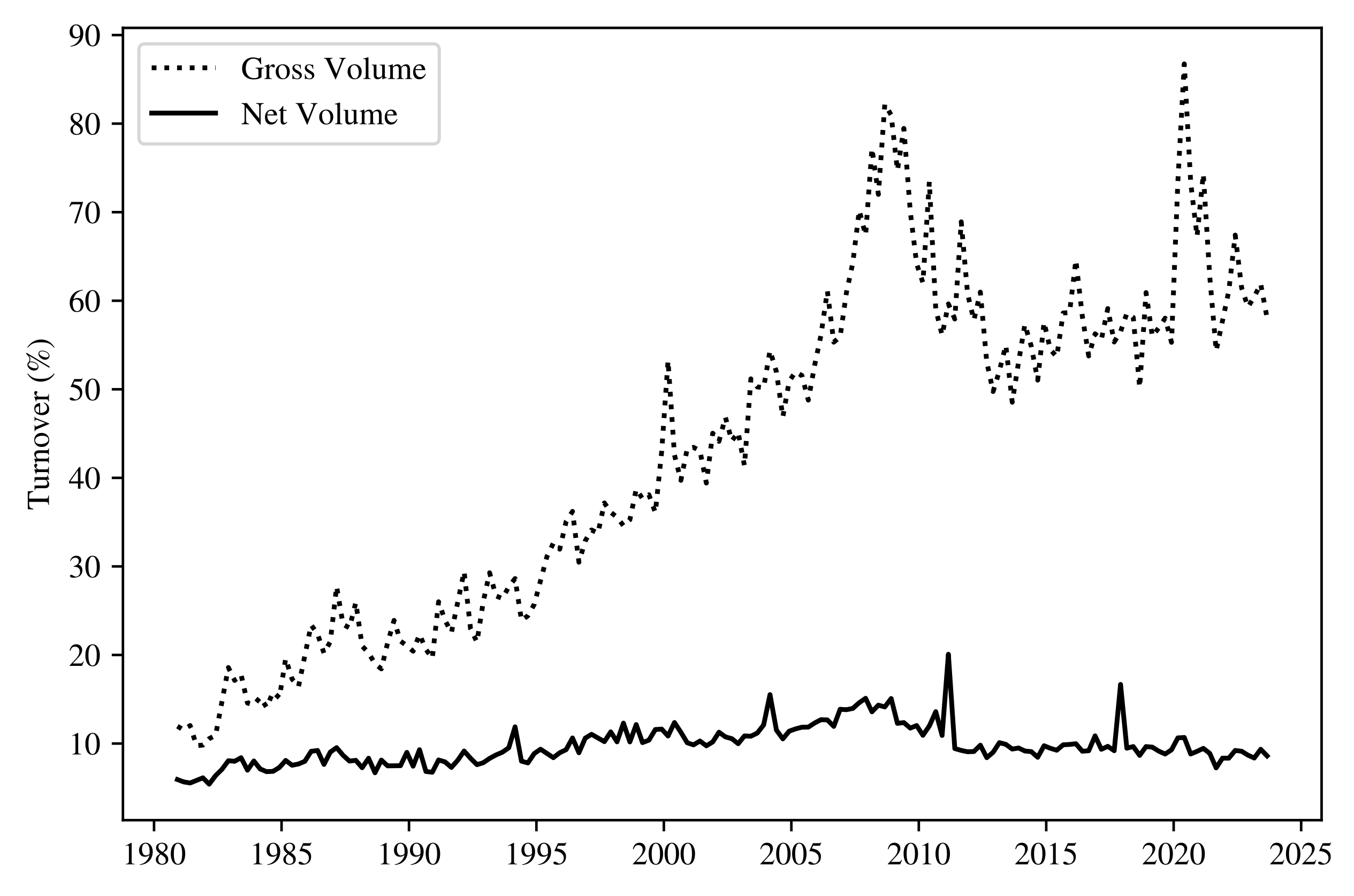

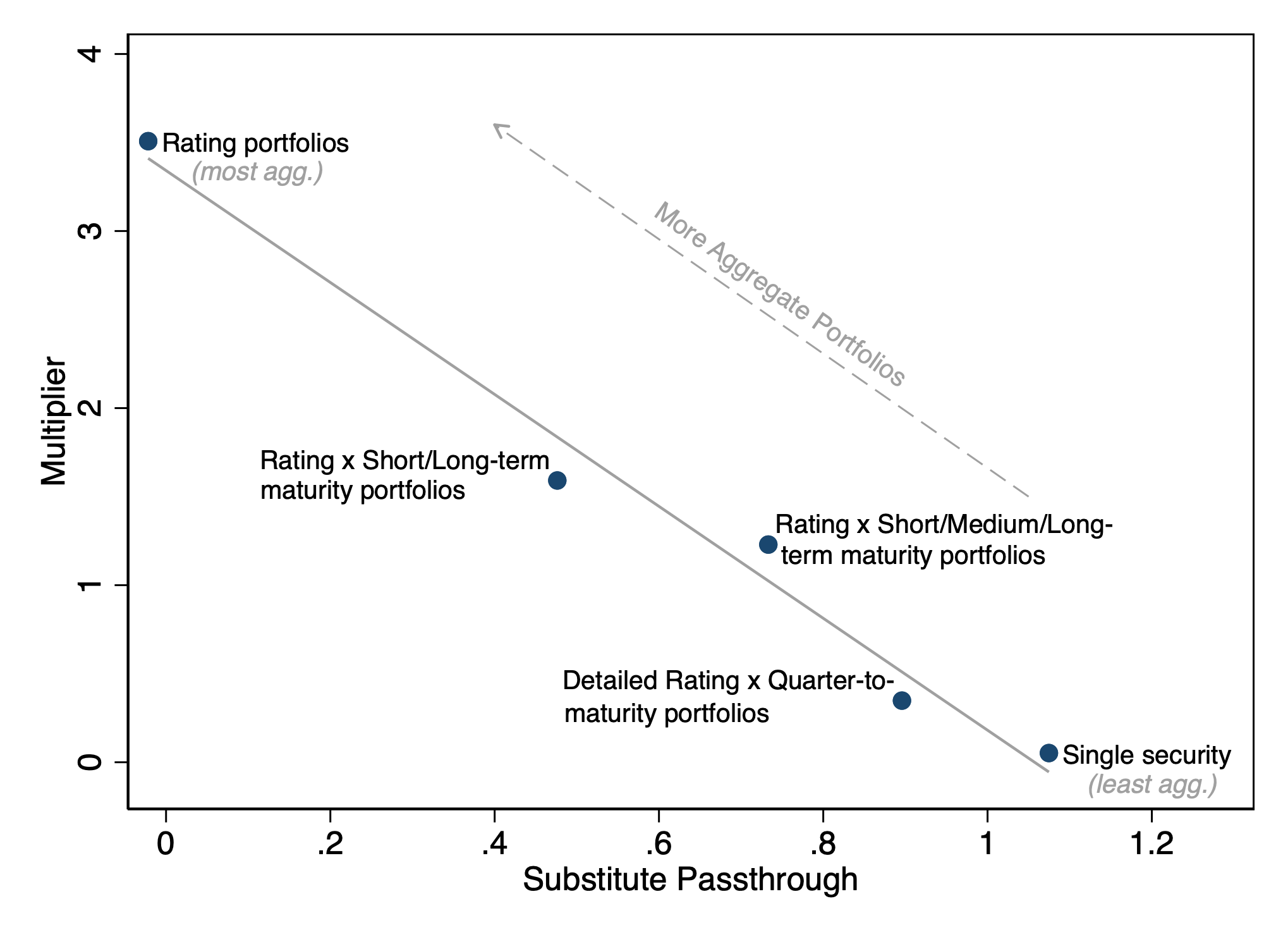

Corporate Bond Multipliers: Substitutes Matterrevise & resubmit at the Review of Financial Studies2024Awards: TADC's AQR Asset Management Institute Prize for best economics paperPresentations: NBER SI 2023 Asset Pricing, Columbia Business School, Trans-atlantic Doctoral Conference 2023, David Backus Memorial Conference on Macro-Finance, AFFECT 2023 mentorship workshop

Corporate Bond Multipliers: Substitutes Matterrevise & resubmit at the Review of Financial Studies2024Awards: TADC's AQR Asset Management Institute Prize for best economics paperPresentations: NBER SI 2023 Asset Pricing, Columbia Business School, Trans-atlantic Doctoral Conference 2023, David Backus Memorial Conference on Macro-Finance, AFFECT 2023 mentorship workshop -

The Great Lockdown and the Big Stimulus: Tracing the Pandemic Possibility Frontier for the U.S.2020Presentations: Bank for International Settlements 2022, International Monetary Fund 2021, Mean Field Games in Economics 2020, Conference on Monetary Policy and Heterogeneity 2020, Banco Central de Chile 2020

Publications

Working Papers

Permanent Working Papers

No matching items