Properties of European Options: Put-Call Parity

Options and Futures

Review of Option Payoffs

- Long underlying assets:

- Long call

- Short put

- Short underlying assets:

- Short call

- Long put

Put-Call Parity

\[C\] \[\large +\] \[ -P\]

\[ C - P\]

Put-Call Parity

\[S_0\] \[\large +\] \[ -K e^{-rT}\]

\[ C - P\]

Synthetic Long: Creating a Forward at \(K\)

\[\Large C - P = S_0 - K e^{-rT}\]

Definition: Long a call and short a put at the same strike price and same expiration date is equivalent to borrowing to buy the underlying asset.

Conditions:

- Non-dividend paying stock

- Not for American options (why?)

- No transaction costs/heterogeneous tax treatment/other frictions

Various versions:

- \(S_0 - C = K e^{-rT} - P\)

- \(S_0 + P = C + K e^{-rT}\)

What happens if the parity does not hold? Buy low, sell high.

Synthetic Shorting

Synthetic shorting: long put + short call

Do you need margin for it?

Does it matter for the stock price?

- Not directly: You don’t sell the stock directly

- But the market makers will sell

- To hedge a synthetic long position from options

- “Gamma squeeze” in meme stocks

- Long short dated options so the market makers have to buy the stock to hedge

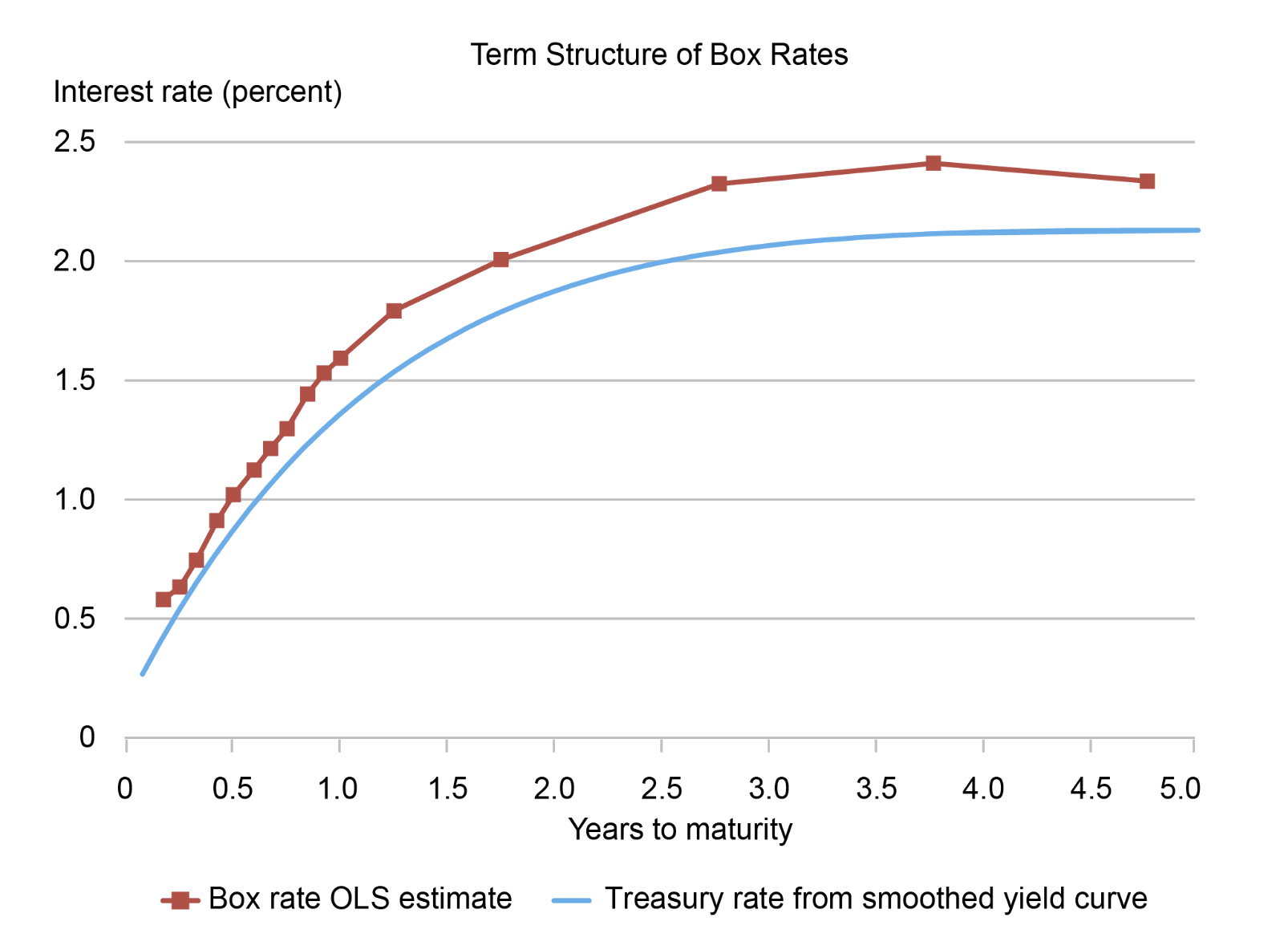

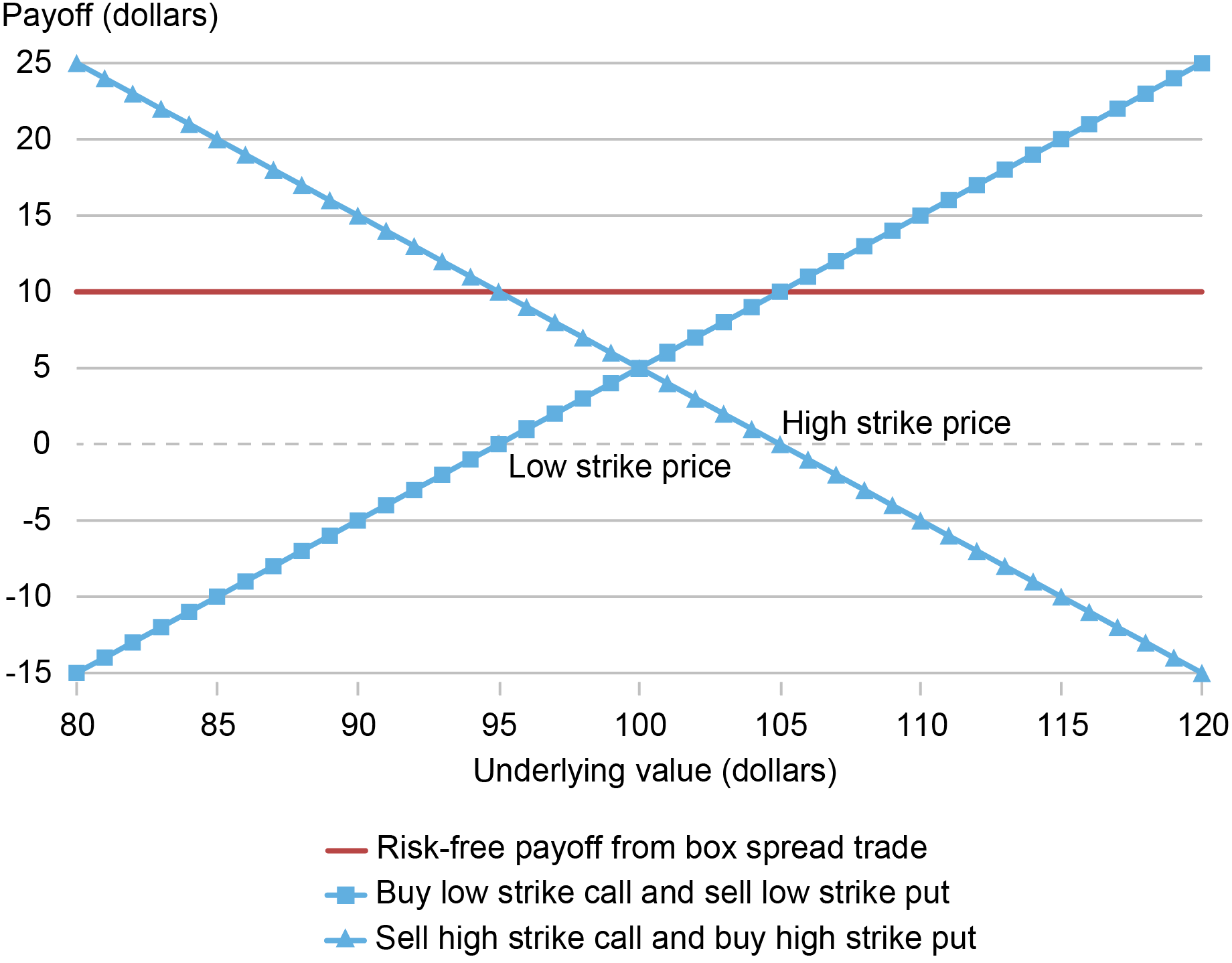

Synthetic Long + Synthetic Short: The Box Spread

- Synthetic long at the lower strike \[C^L - P^L = S_0 - K^L e^{-rT}\]

- Synthetic short at the higher strike \[-(C^H - P^H) = -(S_0 - K^H e^{-rT})\]

- The difference is the box spread \[ \underset{\text{Initial Investment}}{\underbrace{C^L - P^L - (C^H - P^H)}} = \underset{\text{Riskfree Payoff}}{\underbrace{(K^H - K^L)e^{-rT}}} \]

- We created a riskfree bond out of options!

Box Spread

Option Bounds

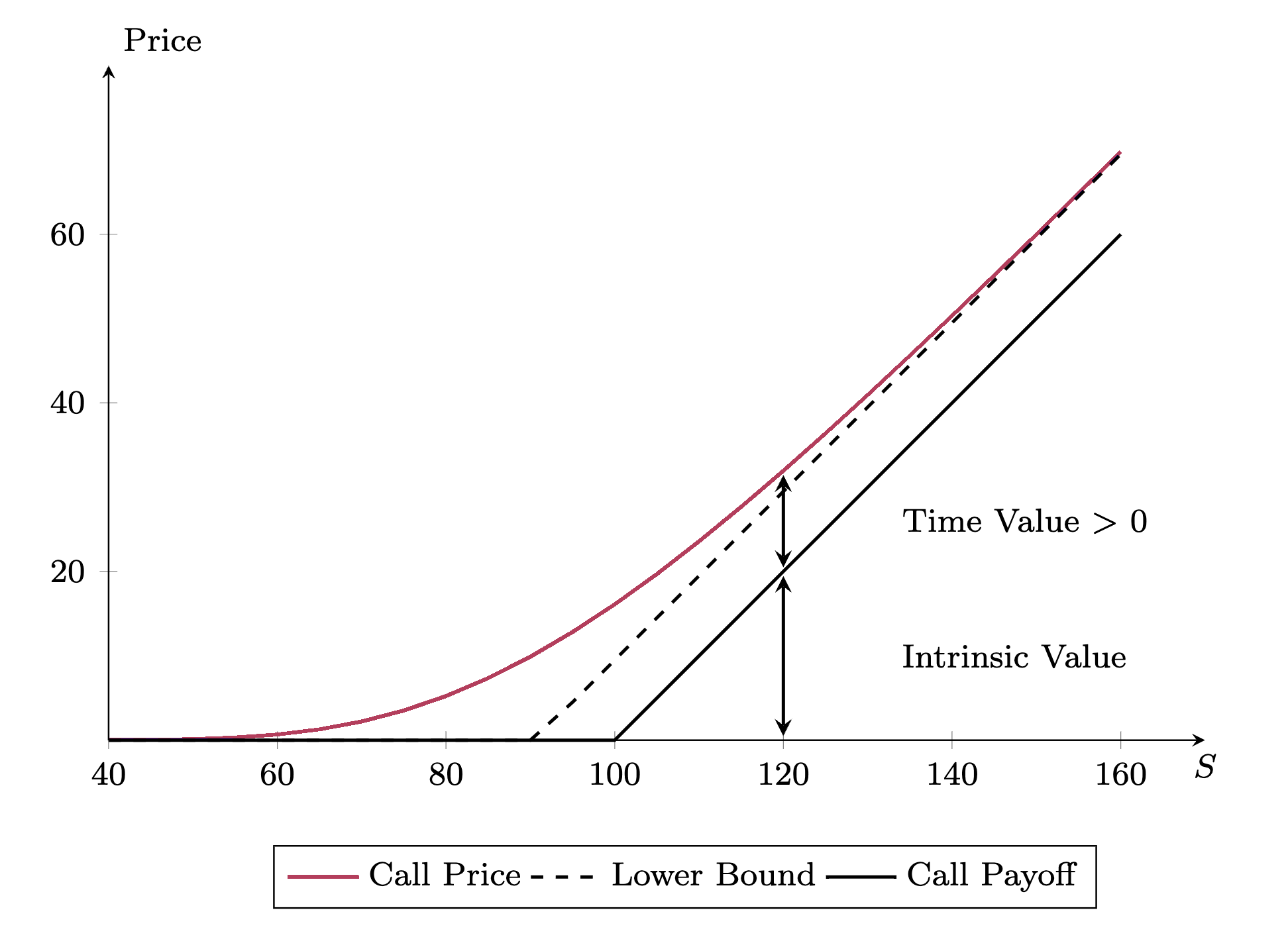

The Lower Bound of European Call Options

Two observations from the diagram: 1. The payoff of the call option is positive \(\implies\) \[C > 0\] 2. The payoff of the call option (solid) is better than borrow to buy the stock (dashed) \(\implies\)

\[C > S_0 - K e^{-rT}\]

From the put-call parity, knowing the put price \(P\) is positive, we have

\[C = S_0 - K e^{-rT} + P > S_0 - K e^{-rT}\]

Taken together, we have the lower bound of the call option: \[C > \max(0, S_0 - K e^{-rT})\]

What happens if the lower bound is violated?

- It is a violation of the put-call parity:

\[C < S_0 - K e^{-rT} \implies \underset{\text{Buy low}}{\underbrace{C - P}} < \underset{\text{Sell high}}{\underbrace{S_0 - K e^{-rT}}}\]

How do we implement this?

Now:

- Buy the call option at \(C\)

- Sell the put option at \(P\)

- Save \(K e^{-rT}\) at risk-free rate \(r\)

- Short-sell the stock at \(S_0\)

Net gains: \(S_0 - K e^{-rT} - (C - P) > 0\)

At maturity:

- If \(K < S_T\), exercise the call to buy the stock at \(K\) using the cash saved, return to the short-sell position

- If \(K > S_T\), buy the stock at \(K\) from the put holder using the cash saved, return to the short-sell position

- Terminal payoff: \(0\)

The Convergence of Call Price to the Lower Bound

Under regular conditions, the call price converges to the lower bound when it’s deep.

Deep out of the money: \[K \gg S_0 \to 0 \implies C \to 0\]

Deep in the money: \[K \ll S_0 \to \infty \implies C \to S_0 - K e^{-rT}\]

- From the put-call parity, \[C = S_0 - K e^{-rT} + P\]

- When \(S_0 \gg K\), \(P \to 0\)

- Implication: European call options for non-dividend paying stocks always have a positive time value!

The Upper Bound of European Call Options

The payoff of a call option is less than the payoff of the stock itself.

\[C < S_0\]

What happens if the upper bound is violated?

Sell a call and use the cash to buy the stock

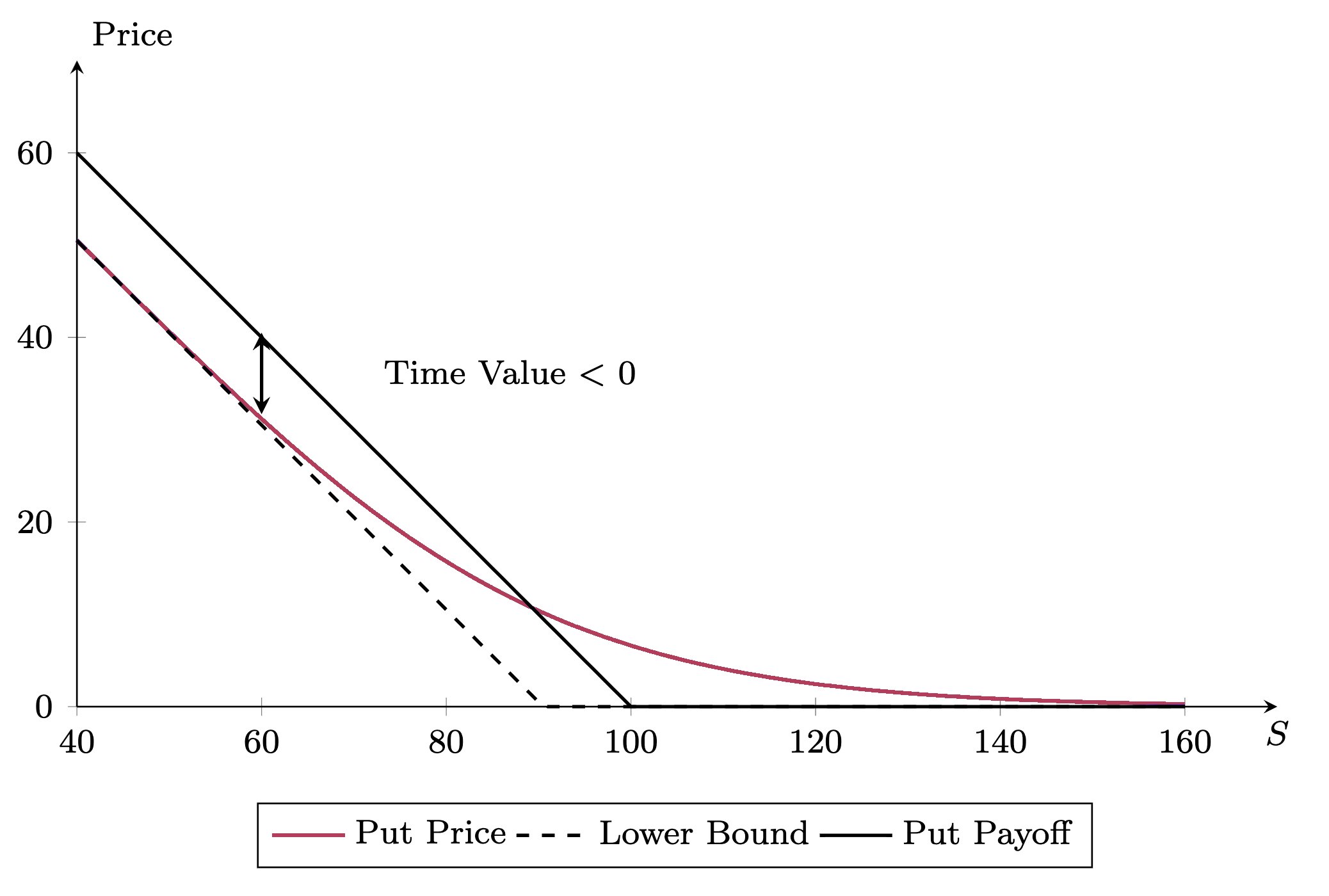

Bounds on European Put Options

- The payoff of the put option is positive \(\implies P > 0\)

- The payoff of the put option (solid) is better than shorting the stock (dashed) \(\implies\)

\[P > K e^{-rT} - S_0\]

From the put-call parity, knowing the call price \(C\) is positive, we have

\[P = K e^{-rT} - S_0 + C > K e^{-rT} - S_0\]

- The payoff of the put option is at most \(K\), \(P < K e^{-r T}\)

Taking together, we have the bounds on the put option: \[ \max(0, K e^{-rT} - S_0) < P < K e^{-rT}\]

The Convergence of Put Price to the Lower Bound

Under regular conditions, the put price converges to the lower bound when it’s deep.

Deep out of the money: \[K \ll S_0 \to \infty \implies P \to 0\]

Deep in the money: \[K \gg S_0 \to 0 \implies P \to K - S_0 e^{-rT}\]

- From the put-call parity, \[P = K - S_0 e^{-rT} + C\]

- When \(S_0 \ll K\), \(C \to 0\)

- Implication: A deep ITM put will have a negative time value