import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import statsmodels.api as sm

# Load datasets

option_file_path = "data/spx_option_data.csv" # Update with your file path

treasury_file_path = "data/treasury_yield.csv"

df_options = pd.read_csv(option_file_path)

df_treasury = pd.read_csv(treasury_file_path)

# Compute box rates for each available maturity in the option dataset

maturity_groups = df_options.groupby('maturity')

box_rates = []

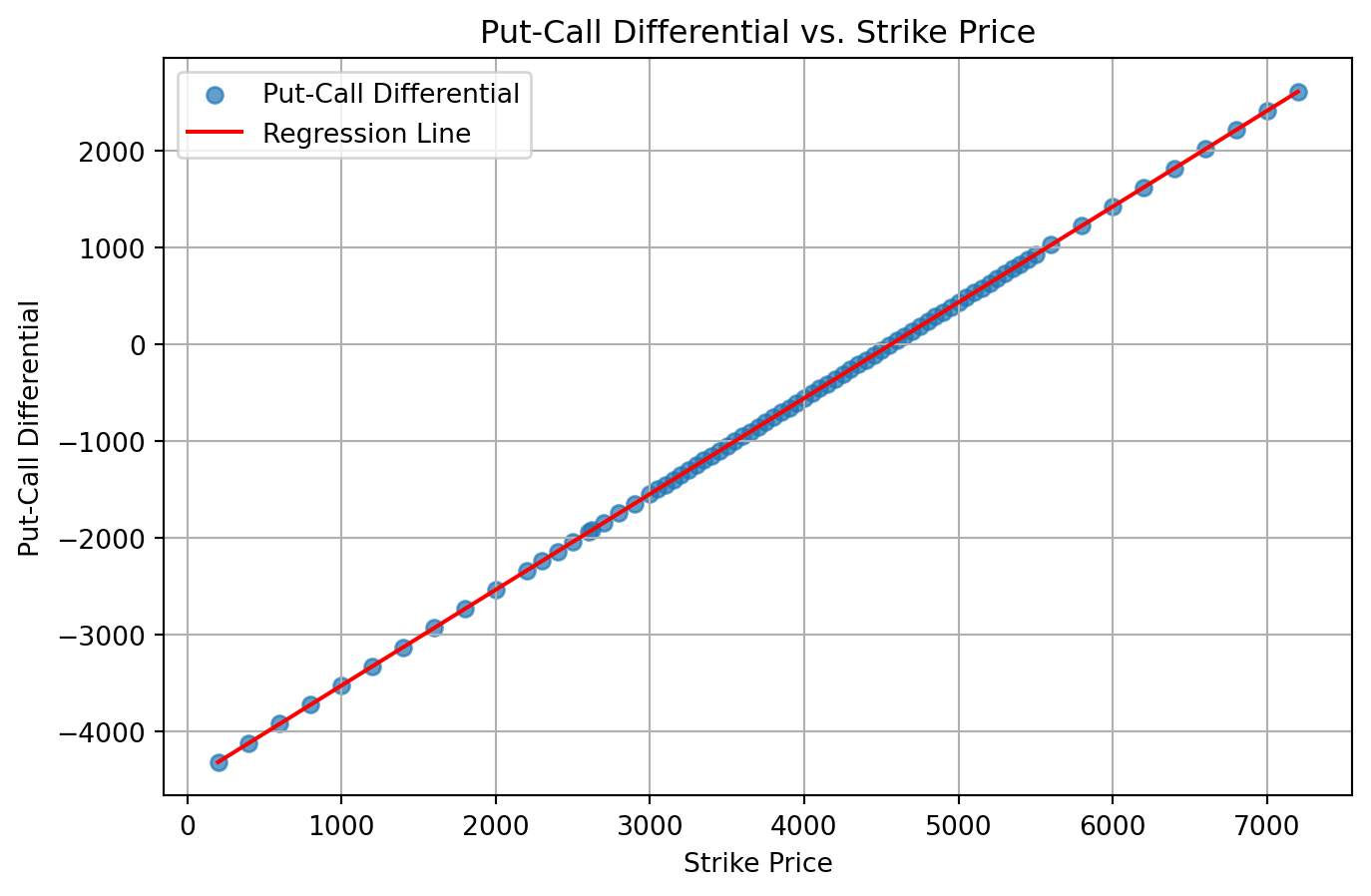

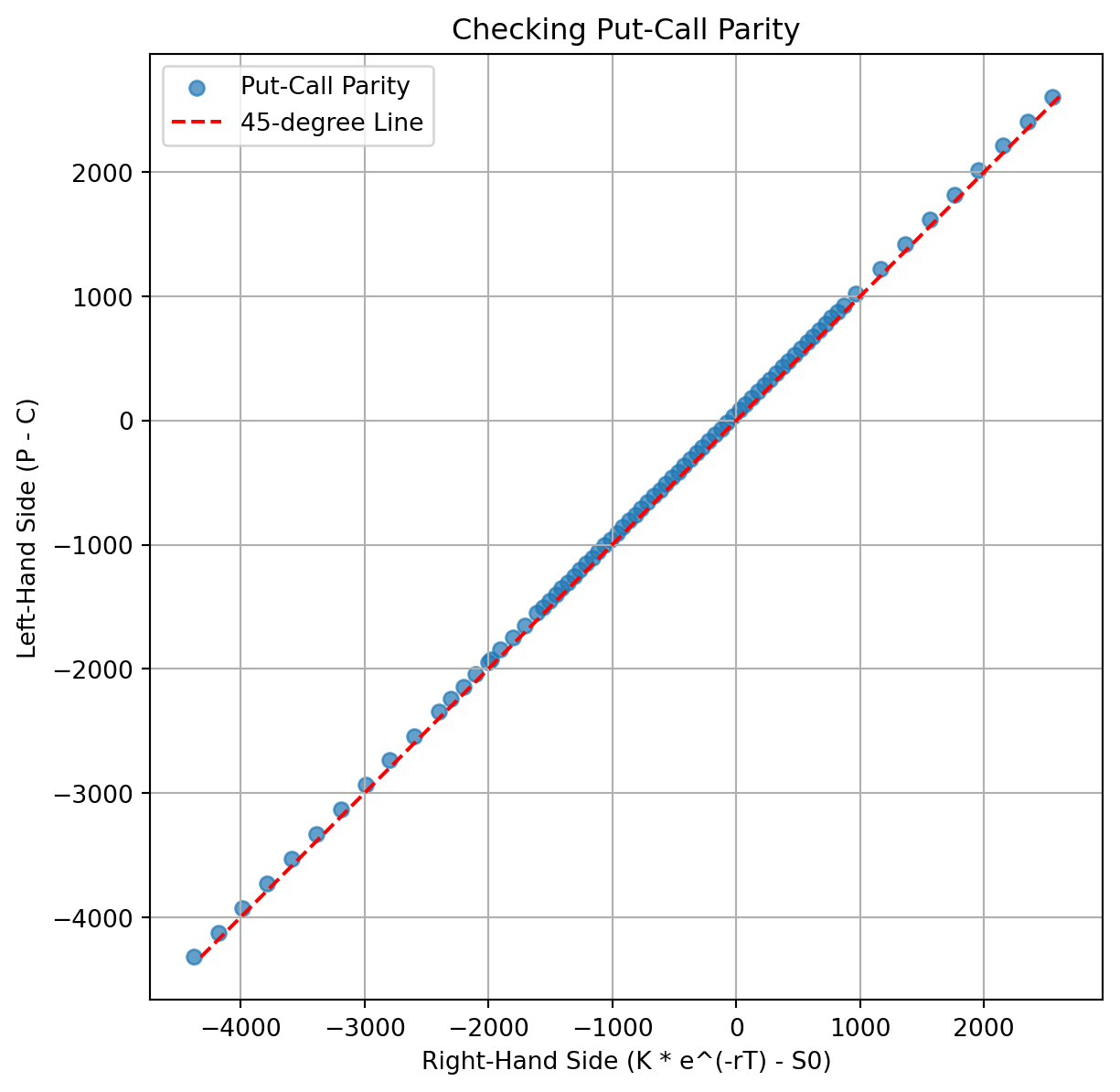

for maturity, group in maturity_groups:

X = group['strike']

y = group['put_price'] - group['call_price']

X = sm.add_constant(X) # Add intercept

model = sm.OLS(y, X).fit()

slope = model.params[1]

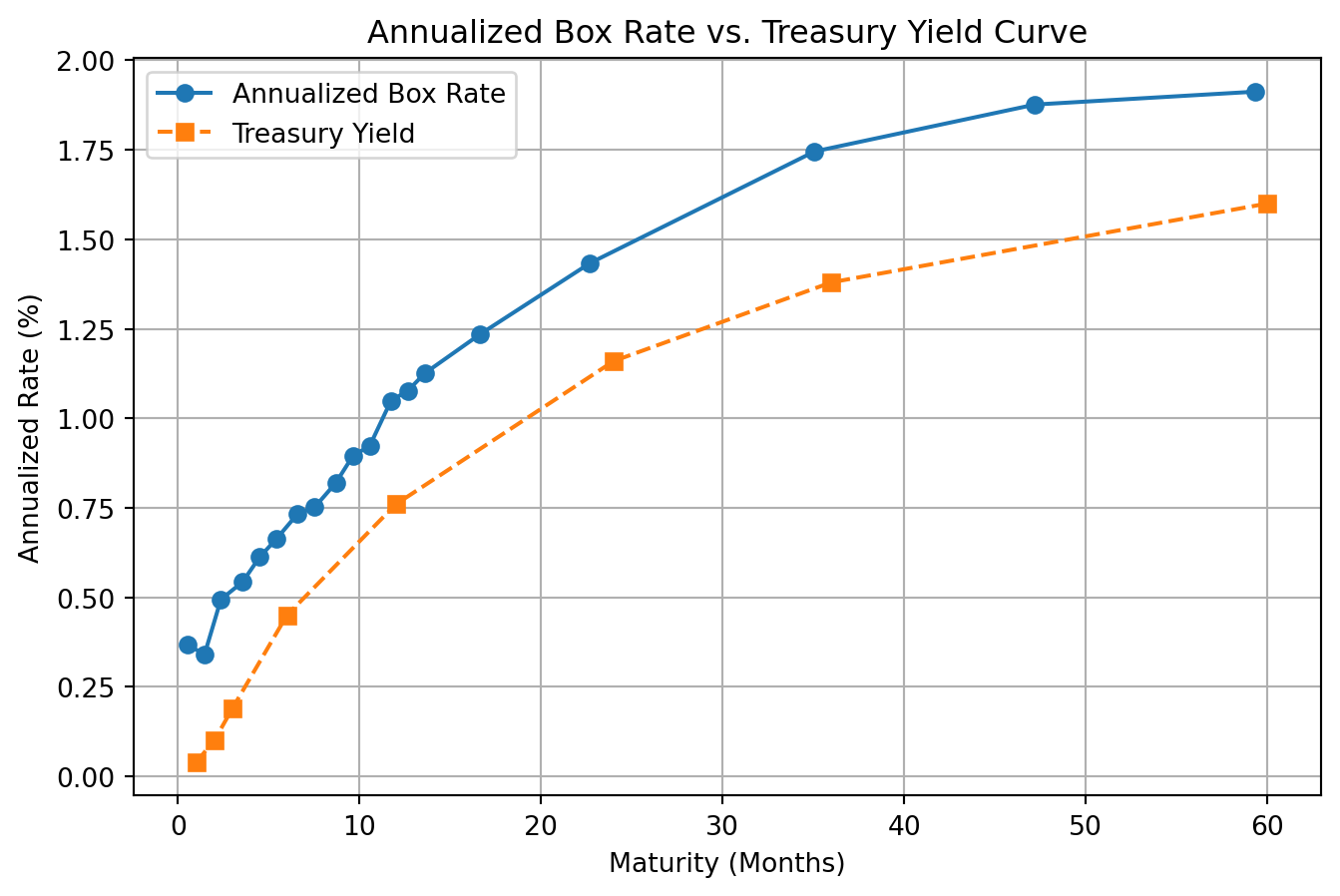

# Compute box rate and correctly annualize it: (R_T)^(360/T) - 1

R_T = 1 / slope

annualized_R_T = (R_T ** (360 / maturity)) - 1

box_rates.append({'maturity_days': maturity, 'box_rate': annualized_R_T * 100}) # Convert to percentage

# Convert to DataFrame

df_box_rates = pd.DataFrame(box_rates)

df_box_rates['maturity_months'] = df_box_rates['maturity_days'] / 30

# Plot the annualized box rate against maturity in months

plt.figure(figsize=(8, 5))

plt.plot(df_box_rates['maturity_months'], df_box_rates['box_rate'], marker='o', linestyle='-', label="Annualized Box Rate")

# Overlay the Treasury yield curve

plt.plot(df_treasury['months'], df_treasury['tbill_rate'], marker='s', linestyle='--', label="Treasury Yield")

plt.xlabel("Maturity (Months)")

plt.ylabel("Annualized Rate (%)")

plt.title("Annualized Box Rate vs. Treasury Yield Curve")

plt.legend()

plt.grid(True)

plt.show()